If you’re thinking about selling your house in Pennsylvania, one of the first things you’ll have to decide on is the selling price. How much should you sell the house for? But you should understand first The 10 Risks of Setting the Asking Price Too High , and how to avoid The “Appraisal Squeeze” when selling a house in Pennsylvania. In our latest post: How to Set Your House Sale Price [NEW Definitive guide for 2020], we’ll answer these questions to help equip you when you sell your house…

Note this is part 1 of a 2 part article series

Table of Contents:

- Overview: Why setting the Asking Price is So Important

- Attracts Buyers & Repels Buyers

- Reveals Information to Buyers

- Sets Starting Point for Negotiation

- The 10 Risks of Setting the Asking Price Too High

- Smaller pool of buyers

- Longer Listing time

- Higher Holding costs

- Miss the “Golden-Window” of listing

- Help the competition

- Reputation Hit

- Appraisal Risk

- Emotional Stress and Uncertainty

- Becoming victim of saving face

- The “Appraisal Squeeze”

- Financial Impact of Setting the Asking Price Too High

- 4 scenario’s explored

Why Is The Asking Price So Important?

When you want to sell your house, you set an asking price (also known as the listing price). The selling price and the asking price are often different– so why set an asking price at all? So how important is the asking price when selling a house in Pennsylvania?

The asking price is actually an incredibly important part of the home selling process. Getting it wrong can add months to the Sale process, and or cost you money. Let’s review what the asking price provides.

First, Your Asking Price Attracts Certain Buyers

There are buyers at every price point in the spectrum. But the pool of potential house buyers goes down as the house price increases. The impact of economic supply and demand is, the higher a house is priced relative to the average in the community, the fewer potential buyers are available.

A house priced above average for an area will attract certain buyers, while it repels low-end buyers. Conversely, a house priced below the average for the community will attract the attention of lower-price buyers (while it repels high-end buyers).

There’s nothing wrong with this – after all, you don’t want to waste your time trying to sell your house to someone who has no intention of buying. So the right asking price can be used to help the right buyers see your house as a desirable purchase.

Second, It Reveals Information To Buyers

The price of your house, in comparison to similar houses in your community, will reveal information to potential buyers. For example, if you live in a neighborhood where the average sale price is $100,000, and your asking price is $75,000, what does that say to buyers? The below average price can send the following messages to potential Buyers:

- your house may need some work

- you’re in a hurry to sell.

- Your house is significantly smaller than the other houses

- There is significant flaw with the lot or house

And what if you live in that same neighborhood but ask $125,000? What messages might the premium price send out to Buyers:

- Your house is larger than the others

- Your house has been updated and or very well maintained

- There are custom features or fixtures in the house

- The lot has some compelling aspect to make it more valuable

Third, The Asking Price Is The Starting Point Of Negotiations

With the exception of very hot real estate markets (high demand, low supply, high appreciation) it’s rare for a house to sell at exactly the asking price. All home sales are negotiations between the sellers and the buyers (and the agents that might represent them). The Seller asking price simply puts a piece of information out there for negotiations to begin from. But it’s the Buyer who actually determines the market value of the property by Agreeing to a price. As a Seller, you might put the price out there for prospective Buyers, and then plan working towards getting a higher price while your Buyers may start with that price with the goal of getting to a lower agreed upon sale price.

Before we explain the best way to go about establishing the sale price for your house, we first need to understand the risks associated with setting the asking price higher than homes similar to yours in the market.

Beware the 10 risks of Setting the Asking Price Too High

It’s natural for home owners to want to get the maximum cash out of their house sale. But it is important to resist the temptation to over price the house, as the fall-out can have dramatic effects on the timing and outcome of the sale. Avoid these 10 risks with setting your asking price too high.

Risk #1: Fewer Buyers

Setting your asking price too high reduces your pool of buyers in 3 ways. First, the simple law of “supply and demand” teaches us that there are fewer buyers available (less demand) to purchase more expensive homes. Second, many home buyers and their agents set up online searches with price brackets (i.e. $300-$350K). If your house is $25K overpriced at $375K, those buyers will never see your house because it falls so far outside of search scope. Third, for the remaining buyers that do see your listing, they will question why it is priced so much higher than the competition. Some of those buyers might visit the house, but most will not make an offer. The Buyers looking at the other houses priced at $375K will see features in those houses that your house lacks, and will be turned off with your property.

Note: A study by the National Association of Realtors suggests that an asking price that is 10% too high reduces the pool of potential buyers by 50%.

Risk #2: Miss The “Golden-Window”

The first 30 days a house is on the market is the known as the “Golden Window”. This is because there is an air of buzz and excitement associated with a new neighborhood listing. This is the time period that generates the highest level of interest from prospective buyers. This is typically the peak demand for the property, and regardless of the condition of the house, the market will have what is widely considered as a “neutral” perception.

The “new listing” buzz and excitement begins to fade after 30 days, and by the third month, negative perception issues can displace the buzz and excitement. Buyers and agents will wonder what is wrong with the house that has been sitting for 90 days.

Risk #3: You Help The Competition

When you list your house for sale, your house is now competing with the other houses for sale in your market. But if you overprice your house, you actually help the other homeowners (your competitors) sell their houses faster. The over-pricing has effectively taken your house out of the market for many of the buyers who might have considered it at a more accurate price. Those buyers shift their focus back to the pool of correctly priced houses in the community. Meanwhile, your competition will certainly appreciate the advantage you have given them with your stumble out of the starting gate.

Risk #4: It Takes Longer to Sell the House

The over-priced house listing, which is now suffering from:

- fewer potential buyers,

- the golden window closing or gone,

- the competition getting buyers attention (and their offers),

… will often, and quite predictably, go through a negative downward spiral that triggers additional negative effects on the house sale outcome, which further accelerates the downward spiral. After 60-90 days of sitting on the market, Buyers perception turns negative towards the house. This downward spiral is often described by real estate agents as “chasing the market down”.

A lengthy listing time risks extending the sale process across multiple seasons, possibly pulling the house out of a prime selling season (i.e. Spring) and into a less favorable season like Fall or Winter. With each passing month the house is unsold, Buyers negative perception of the house increases.

Homeowner Tip: Research has shown that, in addition to local market conditions, home prices fluctuate based on the time of year. Spring can provide up to an +8% boost in home prices, and Winter has a negative effect of as much as -10% on the sale price of a home in markets with cold weather winters. (sources The Appraisal Journal and Collateral Analytics)

Risk #5: Holding Costs Wipe Out Expected Gain

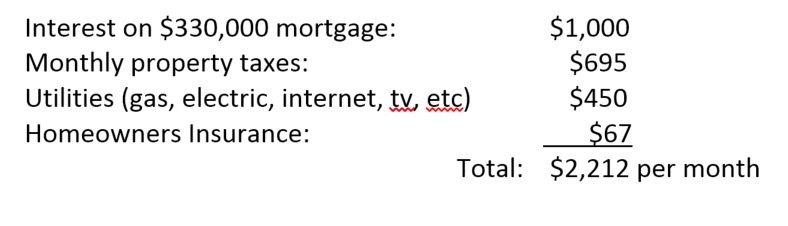

Naturally, while the house sits on the market, the costs associated with home ownership continue. Costs include the monthly interest on a home mortgage, taxes, homeowners insurance, and utilities, which combined, can run several thousand dollars each month. For example, in West Chester PA, the average sale price of a home is $417,000. The Interest on the average monthly mortgage payment would be around $1,000. Adding in monthly property taxes, insurance, and utilities (gas, electric, Internet, TV, water, sewer, trash, etc.), and the monthly holding costs easily exceed $2,000 month (see table below):

Example:

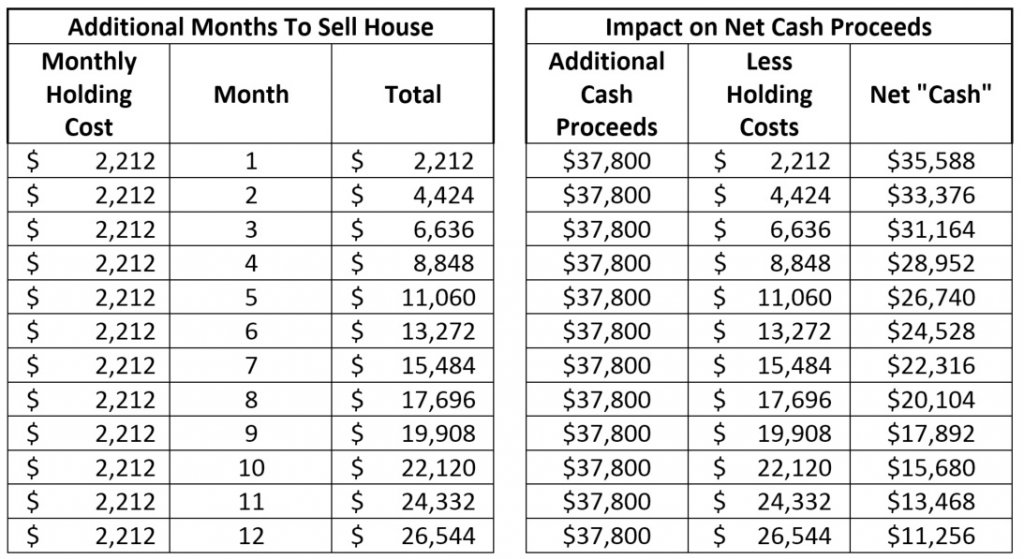

Going back to our simplified example using average home prices in West Chester, PA, each month the house remains unsold (i.e. sits on the Multiple Listing Service or on a For Sale By Owner site), can cost the homeowners $2,200 per month. If the house doesn’t sell for 6-12 months, the homeowners have incurred an additional $13,000-26,000 in holding costs.

Risk #6 Damage To Your Reputation

How do your neighbors and other members of your community feel about your decision making if you significantly over price your house? The overpriced listing isn’t helping you, and it isn’t helping your immediate neighbors. Your overpriced house is helping the competitive houses in nearby communities sell, but doing nothing for the immediate houses around yours. Maybe the immediate neighbors are friends or acquaintances. While the neighbors will miss you, they still want the process to go smoothly and quickly.

It goes without saying that the neighbors want you to maximize the final sale price of your house, but not by being foolish. Nobody benefits from a house sitting idle on the market for 6 – 12 months. They will have new relationships to build once you move, and will perhaps spend less time with you after the move. This “pre-move” time period will become increasingly weird as the neighbors wonder what you are doing with your asking price. And these questions will likely impact how they perceive your financial decision making and may even add to your emotional stress.

Risk #7: Emotional Stress and Uncertainty Takes A Toll

As the saying goes, “…there’s no free lunch”. We can apply that saying to the impact of over pricing the home sale asking price. In reality, the overpriced house issue boils down to money, and money is the second highest cause of relationship fallout (i.e. divorce). Selling a house requires the Sellers put in the required work to prepare the house for showings.

Once repaired, prepped, and cleaned, homeowners need to maintain this “high-ready” state – to be ready for showings for potential buyers. Their normal lives and activities can be thrown into chaos. Normal every day stuff has been stowed away so the house looks uncluttered, some of the kids toys have stored away, house cleaning has been more frequent, all in anticipation of a call from your agent for a showing to a potential buyer. The call forces you to change your schedule, do once-over prep on cleaning and stowing “stuff”, and then get out of the house for a few hours with the family and going somewhere.

Try to picture the following scenario:

- house doesn’t sell for months,

- the competitor houses are selling,

- the neighbors’ concerns increase,

- homeowners in perpetual “ready state”,

- the house is sliding out of prime selling season,

- and the holding costs mount up,

What’s happening to the emotions of the homeowners? The following questions and more likely come up and can impact the relationship of the Sellers:

- Do the Sellers start looking for blame?

- Are school, work, and moving plans thrown a massive monkey wrench?

- Is commuting becoming a burden?

- How long will the emotional roller-coaster of “high-ready state” last?

- Why is this taking 2 to 3 times longer than planned?

- Is our agent on the same page with the Sellers or do they have different motives?

- Is our agent (if using a broker) out of touch with the local market conditions?

Selling a home is already a high stress and high hassle period, fraught with risk, and uncertainty. Over inflating the asking price is a sure fire way to make the entire process significantly worse by adding more risk, more uncertainty, more cost, and more doubt to the entire process.

Risk #8: Saving “Face”

Many people don’t like to admit they were wrong. It’s understandable and yet kind of silly in a way – because one of the most prominent features of being human is that we make mistakes. Yet mistakes can be a powerful learning tool.

Admitting we were wrong or we made a bad decision with the asking price is an insecurity that can have drastic impact on the overpriced house listing. Will our spouse think less of us? Will we prove the nay-sayers right? Do we have a deep seated insecurity about being wrong? Will the agent or home owners question the quality and competence of our decision making? These can be painful emotions that inhibit rational decision making, and it may seem easier to plow forward with the current plan, than wrestle with these fears.

But the worse possible reaction to the house sitting idle is doubling down on the high asking price, and plowing forward. It is likely that the same personality that pushed for the over inflated asking price will have difficulty in making a timely self-correction.

Risk # 9 – House Does Not Appraise For The Asking Price (Appraisal Risk)

If the homeowners have weathered the first 8 risks, there is still big trouble that lies in waiting at the end of the inflated-asking-price-tunnel.

Most buyers will need a mortgage to purchase the house, and their offers will include a Financing or Mortgage Contingency. Regardless of the financial qualifications and enthusiasm of the Buyers for your house, most bank lending programs have guidelines that they won’t exceed.

One of those guidelines is the Loan-to-Value ratio (LTV). Banks look at the collateral (the house) as a guarantee for the repayment of the loan. The meaning of “value” in Loan-to-Value in this case does not necessarily mean the agreed upon Sales price between the Buyer and Seller. The Appraised Value, which could be lower, will set the LTV ratio in the Banks opinion. And since the Bank wants to ensure the collateral gives them plenty of cushion to offset a loan in default, their word on the LTV is final. Banks will nearly always use the lower of the Sale Price or the Appraised Value when it comes to their lending limit, and this introduces the concept of “Appraisal Risk”.

Note: Most buyers will typically have a Finance Contingency clause in their offer, meaning if they can’t obtain a mortgage within certain reasonable parameters, then Buyers can declare that they are released from the Agreement of Sale, or simply terminate the Agreement, and get 100% of their earnest money deposit back. Excluding offers from Buyers with Financing Contingencies reduces the pool of available buyers in a market.

The best long term fixed rate mortgages are known as “Conventional” mortgages. A typical LTV ratio for a 30 year conventional mortgage, for the current best interest rates, is an 80% LTV limit (i.e. the bank will lend up to 80% of the value). Any offer with a Financing Contingency, has a risk of the house appraising for less than the sale price. That risk is magnified with an inflated asking price, and a very tricky problem can follow

Let’s use our West Chester PA average house sale price of $417,000 as an example to illustrate an 80% LTV mortgage. For this simplified example (no closing costs), the buyers would provide the 20% of the sale price, or $84,000 in cash.

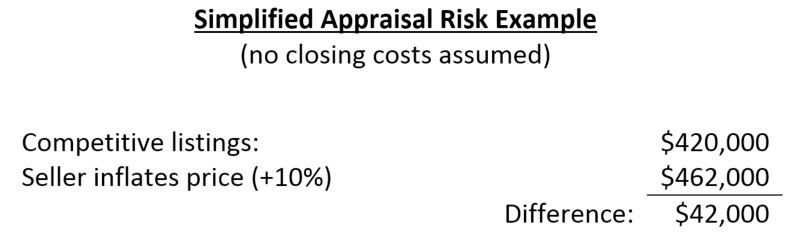

Let’s also assume that the Homeowners house is very similar to other houses that are listing and selling for around $420,000, but the Sellers decide to inflate the list price of the house by 10% higher than the competition. The Sellers decide to list the house with an asking price of $462,000.

A Buyer comes along and agrees to the Sellers asking price, but, the offer has a Financing Contingency Clause. The Buyers typically need 60 days to work with the bank to secure financing for the closing. While the Sellers now have a bone-fide offer in hand, and an agreement of sale, it will still take another 2 months to close.

Once under agreement, the Seller applies for the mortgage, and the bank will order an appraisal of the house. The appraiser, who is an independent estimator of the market value, has rules to follow to justify his or her opinion. The appraiser must consider the sales of similar, nearby property to yours. If those properties are selling for $417,000, it will be difficult to appraise the house much higher than the competition. So if the house appraises a little higher than the competition, let’s say at $425,000, the bank will only lend 80% of that value, or $340,000. Our intrepid Buyers were expecting the bank to loan them $369,600! Who comes up with the additional $25,600?

Now the buyers may be in a position to make or break the deal. Keep in mind, another 3-4 weeks have elapsed since signing the agreement, on the already stale, over-priced listing. Let’s run through some scenarios, ordered from best to worst, on what could happen next.

Scenario 1 – Buyers Pony Up

It’s possible the Buyers decide to pony up the additional $25,600, because they are suffering from an irrational love for your house. Don’t count on this option!

Scenario 2 – Buyers Counter Offer

Faced with the prospect of paying an extra $25,600 over market value for the house, and having to provide that cash themselves, the Buyers likely come to the realization that they shouldn’t overpay. But they may have some emotional connection to the house now, so they come back to the Sellers to renegotiate. The Buyers might counter offer for a lower price, and say something along the lines of:

“Dear Homeowner, we love your house. However, an expert just appraised it at $425,000. Your asking price is higher than the market value. And while we do want to buy your house, we would be foolish to pay over the market value, as we may never see the return on that investment. If you don’t accept $425,000 as the agreed upon price, which is the appraised value for the house, we will cancel the agreement, and take back our deposit.”

Clearly this would be a reasonable course of action for the Buyer and a very unfortunate development for the Seller. In this Scenario, Sellers would face the prospect of starting the process over again and relisting the house if they don’t reduce asking price to the appraised value.

Scenario 3 – Buyers Apply Pressure to Sellers

Another outcome, which can and does happen, is the Buyers feel empowered or perhaps misled, or maybe even both, and decide to use the appraisal to apply pressure to the Seller situation, and “club” the Sellers into accepting a lower offer.

This is such a severe and probable outcome that the term “Appraisal Risk” really doesn’t do it justice. We’re moved beyond a risk with this scenario, and are now facing losses. We call this situation the “Appraisal Squeeze”. Here’s an analogy – picture a wrestling or jujitsu move where your opponent has a pinning or submission hold so deep, that further resistance on your part is probably going to result in real harm. The phrase “tapping out”, means you submit or give up, to minimize certain harm. Similarly, accepting the Appraisal Squeezed offer, can put the brakes on further losses.

The “Appraisal Squeeze” is a possible outcome from a seller inflating their asking price above the market price sales. If the Buyer decides to pursue the tactic of the “Appraisal Squeeze” on the Sellers, who are now in a weakened position, here’s how it might sound:

“Mr. Homeowner, we just spent $300 to have an expert appraise your house and in his opinion, it’s only worth $425,000. Your asking price is much higher than the market value. And while we did like your house, now we question your integrity, and we feel misled. We would be foolish to overpay for the house.

We see that your house has been on the market for 6 months, and the slow season is coming. It would likely take you another 30 days to find a different buyer, and 60 more days to close, adding another 3 months to your holding costs. Plus you’ll have to discount the house price for the off-season. Our bank financing is complete and we can close in 2 weeks, but we will only offer you $415,000 for the house. If you don’t accept $415,000 as the agreed upon price, we will terminate the agreement, and take back our deposit.”

If the Buyers are working with a Realtor or an Attorney, the likelihood of the “Appraisal Squeeze” being applied goes up. This becomes an extremely stressful situation for the Sellers, and they likely have an emotional reaction like “go take a hike!” Not only did the Sellers receive a cold-water splash of reality check to the face but they received a punch to the gut. This demonstrates the weak position or negative perception of the house in the market and the Buyers may try to capitalize on the situation.

A rational Seller really needs to take a deep breath, calm themselves, and take stock of their situation. It may be wise to examine this new offer and consider accepting the lower price to stop the financial loss from going any further. Accepting the $415,000 offer, though $10,000 less than the appraised value of $425,000 means the homeowners can ensure they don’t incur an additional $6,000 in holding costs. If they have gambled this far (i.e. 6 months) to get to this point, and are out of peak house selling season, what are the odds they get a better offer in the next 2-3 months? And even if they do gamble and receive a “better” offer, what are the odds it yield’s an additional $4,000 in proceeds, given the track record thus far?

Scenario 4 – The Buyers Walk Away

The Buyers could also exercise their “out clause” in the Financing Contingency, terminate the agreement of sale, collect their deposit, and the deal is now dead. Back to the drawing board for the Sellers

Risk #10: Reduced Price Phenomenon

If you recall our review of the Golden Window of listing a house for sale, we know that the time frame to receive the most offers is typically the 1st 30 days on the market. That’s when the house has “buzz and excitement”. But when a house sits on the MLS more than 30 days, the market perception of the property starts to shift from positive, to neutral, and then to negative. Buyers and agents begin to suspect something is wrong with a house that has been sitting.

Buyers also realize, that as time goes on, that negative perception increases. Over time, if any offers on come in for the overpriced house, they tend to be for less than asking price. If the Sellers wait too long to drop their inflated asking price, to increase the pool of potential Buyers, the negative perception still remains. Often the offers at this point continue to come in lower, and this downward spiral of lower asking price, more buyers, but lower offer prices continues. The most common way to escape this negative perception spiral is to pull the market off the house, wait a few months, and hope for a relisting at an appropriate price in the future.

Asking Price too High – Financial Impact

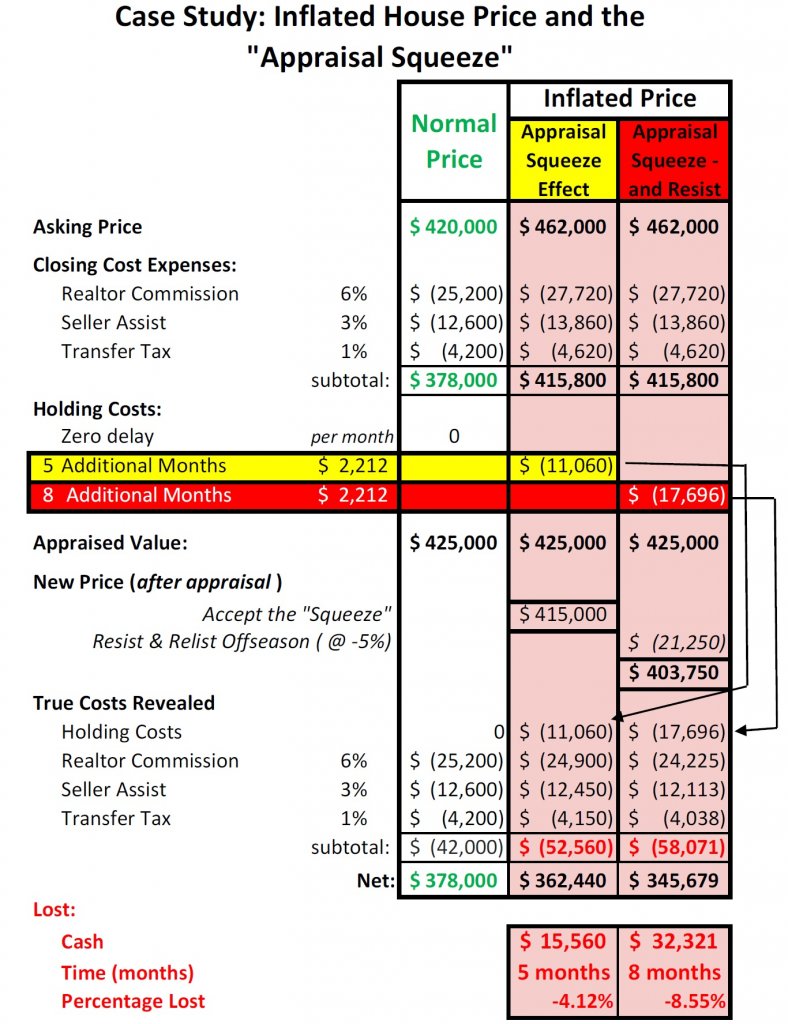

Let’s review where the Sellers now stand from the inflated asking price starting point with each of the 4 scenario’s from above. We’ll begin with the over-simplified West Chester PA average house price example.

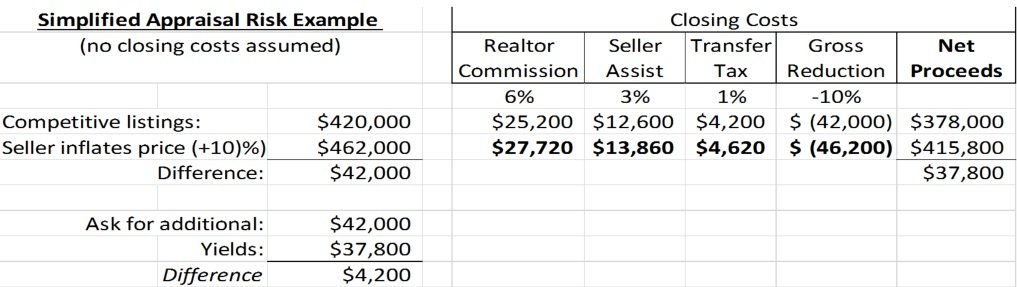

Sellers are hoping to net an additional $42,000 with the above example. But there are transaction costs associated with the sale of real estate, and we’ll include some common examples in the next table:

Even though Sellers are asking for an additional $42,000 with the inflated asking price, their transaction costs increase with the higher price, diluting the amount of cash they receive, so they actually receive $37,800 – a difference of $4,200.

Now we’ll explore the impact of holding costs on the Sellers, and observe how the passage of time is really the biggest risk and threat to the proceeds they receive for their house sale.

Hopefully, you the Seller, are still following along and recognize that an asking price higher than similar competitive homes will:

- reduce the pool of buyers,

- and increase the days on market,

- and more time on market = higher holding costs

A typical house sale will take 60-90 days to close with all of the right conditions being met (i.e. priced right, no hiccups). Going back to our example holding costs of $2,212 per month (Risk #5), if we factor in the additional holding costs from an inflated listing price, how does the longer listing impact expected proceeds?

As we can see, there are diminishing returns associated with an inflated asking price and longer listing time. Based upon the table above, a Seller might be thinking “I might chance this risk for a few months …” Now let’s make this example more realistic and add in likely days on market, and Appraisal Risk.

In our example market West Chester, PA, the average Days on Market is 42 days. That’s for a competitively priced house, similar in size, features, condition, etc. It’s prudent to add on another 60 days for closing, so the Buyer can get their Inspections and Financing completed. Conservatively, that puts the closing at 4 months out from the listing date.

We know that a higher price 1) reduces our pool of buyers, and 2) increases our listing time. Any forecasting of those 2 effects is simply estimating as every seller and market is different. So we’ll make an assumption to illustrate a point. Here’s the assumption – each 2% above competitive priced homes, adds 30 days to the listing time for a property. So, we can build a table as follows:

- 2% price increase requires additional 30 days on market

- 4% price increase requires additional 60 days on market

- 6% price increase requires additional 90 days on market

- 8% price increase requires additional 120 days on market

- 10% price increase requires additional 150 days on market

*This is just to illustrate a point. We don’t have data to back up these estimates of “additional days on market” up, but the point is still valid.

Let’s apply this time table to our case study, and factor in the fallout often referred to as Appraisal Risk. We’ll assume 1) our Sellers set an inflated price that was 10% above the market. And 2), because the Buyers felt misled, the Buyers responded with Scenario 3 – the Buyers used the Appraisal Squeeze effect:

As we can see from this example, the financial risks with inflating the asking price of the house over the rest of the market competition as caused the house to sit of the market longer, and has yielded the Sellers LESS cash than the appropriately priced house.

In part 2 of this article, we’ll explore the risks associated with setting the Asking Price too low, and finally, we’ll detail the information you need, and the steps to take, in order to accurately set your house asking price so that your house sells fast and you maximize your cash proceeds.